Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. An RPC is a company that owns real property in Malaysia or shares in other RPCs to the extent the value of its real property or shares in other RPCs or both is 75 percent or more of the total tangible asset value of the company at the relevant time.

Share Transfer Procedure In Private Limited Company Ebizfiling

D Homeowners who own low or medium cost housing priced or valued below RM200000 are exempted from RPGT when disposing of their property.

. Relief on the transfer of the undertakings or shares under a scheme of reconstruction or amalgamation of companies conditions apply. To assemble a bowl of laksa for serving bring to boil some yellow noodles and a handful of bean sprouts. Withdrawal of shares of delisted company and closing of CDS account.

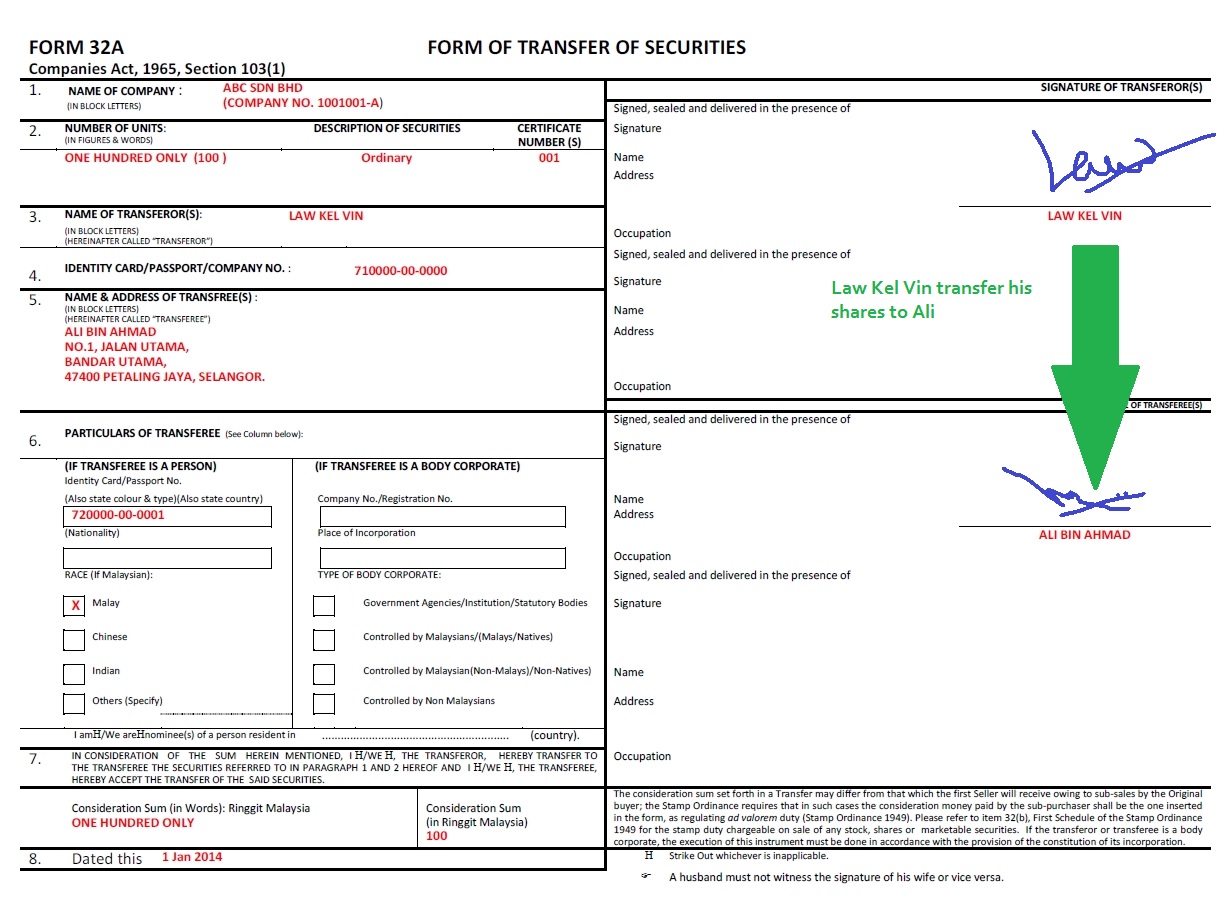

To write an application TC Transfer Certificate from school or Transfer Certificate from school and college follow the steps below-Write the details of the person School Principal who will issue the TC along with the institute name and address. It cannot allot shares or debentures with a view of offering them to the public s431. Under s151 of the CA 1965 a private company was prohibited from inviting the public to subscribe its shares or debentures.

It can get a bit technical but bear with us and just keep these two words in mind. Read more at The Business Times. Transfer the shrimp boil to a sheet pan or serving platter garnish with chopped parsley and serve immediately.

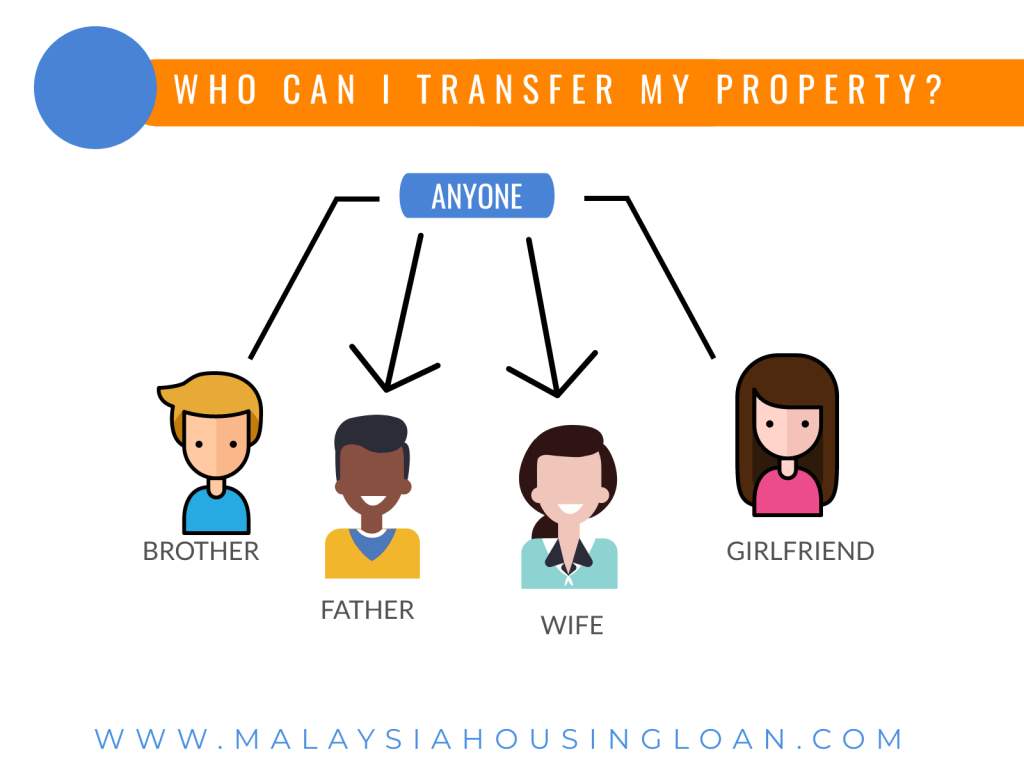

ARLINGTON Texas West Virginia has had a successful offseason in many areas according to coach Neal Brown and one of those has been the rebuilding of a defense via the transfer portal. This could be an electronic bank transfer or credit card payment. Husband wants to transfer his 50 shares to wife.

Stir to combine well. Deposit any fiat value into your Luno Wallet using your preferred method of payment. Its possible to inherit shares or be given shares by someone else without a broker.

Form 24 consist of the latest amounts details of authorised capital paid-up capital of a sdn bhd company. Wife will own 100 shares after the transfer. The form needs to be submitted to SSM for registration once the allotment were approved by the directors existing shareholders.

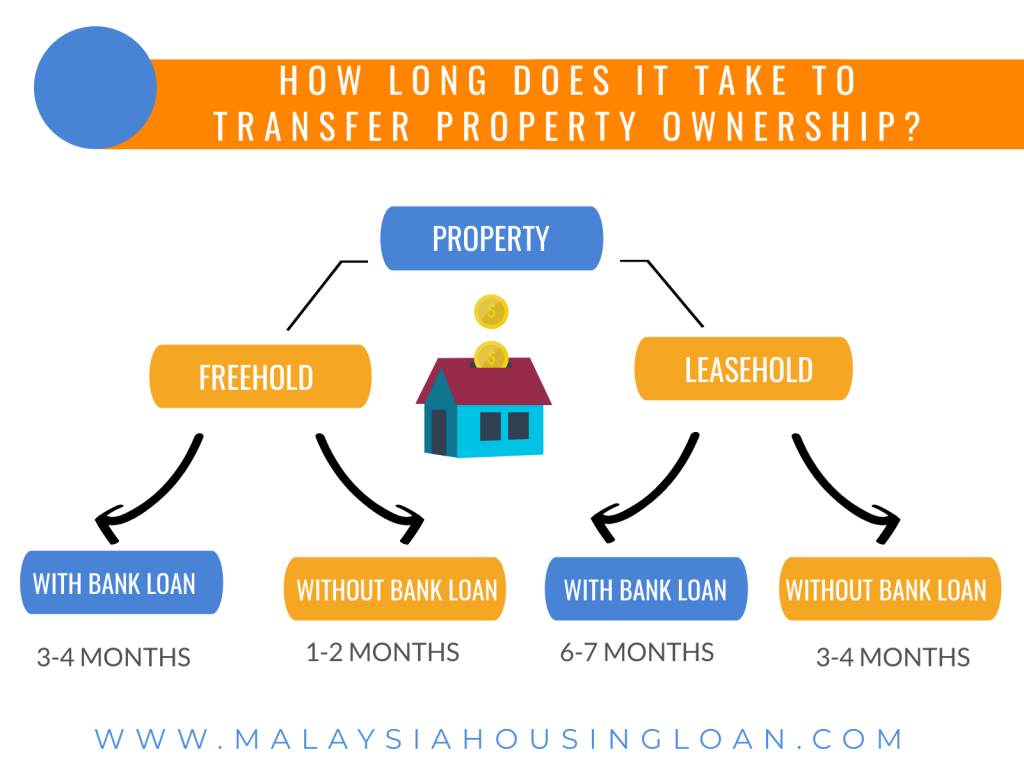

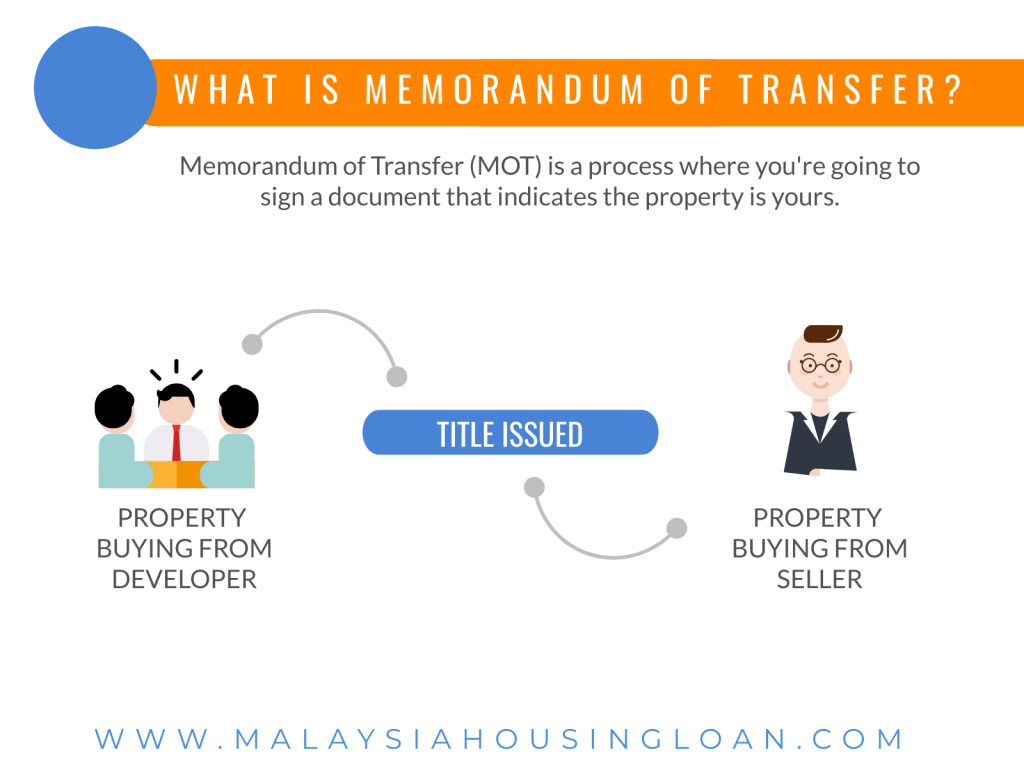

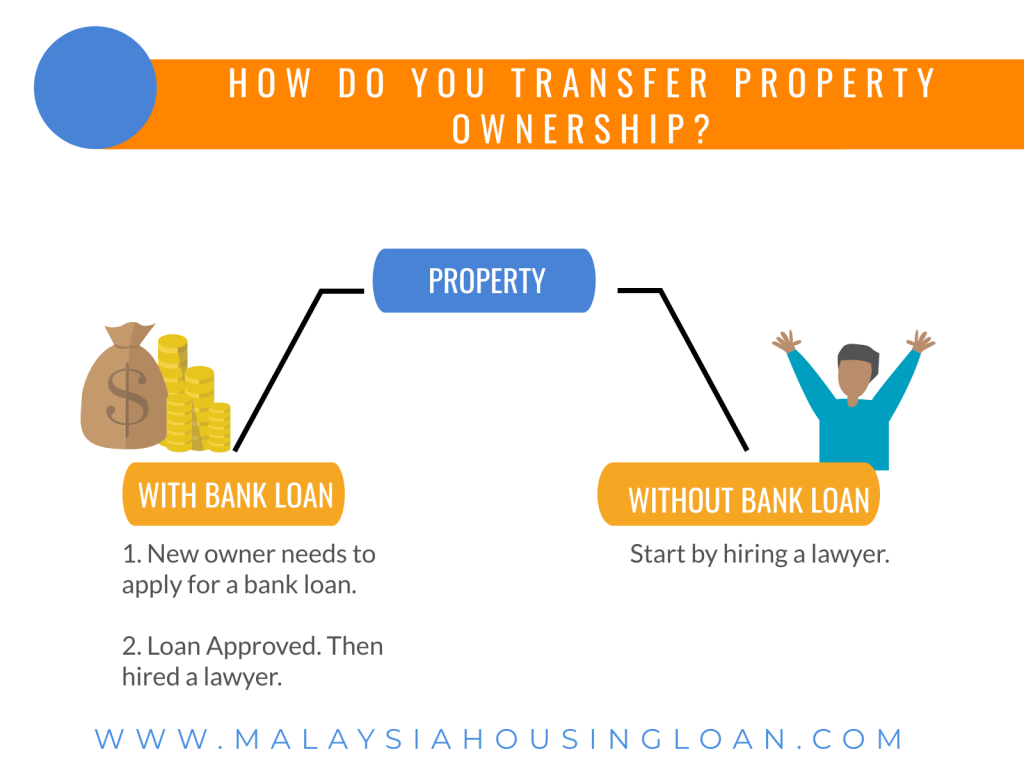

Property market value is RM400000. Memorandum of Transfer MoT and stamp duty. If the asset is jointly owned by 2 individuals both need to be Malaysian citizens to make the transfer.

Case law is provided in full length and for all content not originally written in English an optional machine translation of the text is available. This is called an off-market share transfer. Husband wants to transfer his ownership to wife.

The Sarawak secretarys office in a statement today said it had checked with the state police commissioners office and was informed that. Buy the cryptocurrency of your choice. C If an asset is transferred to a company then the asset owner or owners spouse must be a Malaysian citizen.

Sometimes companies raise extra capital by selling new shares via an off-market share purchase plan. May 21 2021 at. Brown is banking on veteran leadership from the likes of Dante Stills Taijh Alston and Charles Woods but believes that the experience of some of his.

Lower stamp duties payable on the transfer of shares compared with other physical assets. Youll need the Borang 14A. Agreements executed from 1 January 2021 to 31 December 2021 in respect of financing facilities approved by Bank Negara Malaysia for small and medium enterprises SME ie.

It restricts the transfer of its shares s422 It cannot offer its shares or debentures to the public s431. Top the noodles with 2-3 shrimp a few pieces of fish cake and some eggs. What is the format to write an application to the principal to issue a transfer certificate.

MALAYSIA share prices opened lower on Wednesday with the FTSE Bursa Malaysia Kuala Lumpur Composite Index down 778 points or 052 per cent to 148727 as at 914 am. Remember the aim of transfer pricing rules is to prevent Multinational Enterprises from shifting profits between entities and as a result not paying the correct amount of taxes. Drain the noodles and bean sprouts and transfer to a serving bowl.

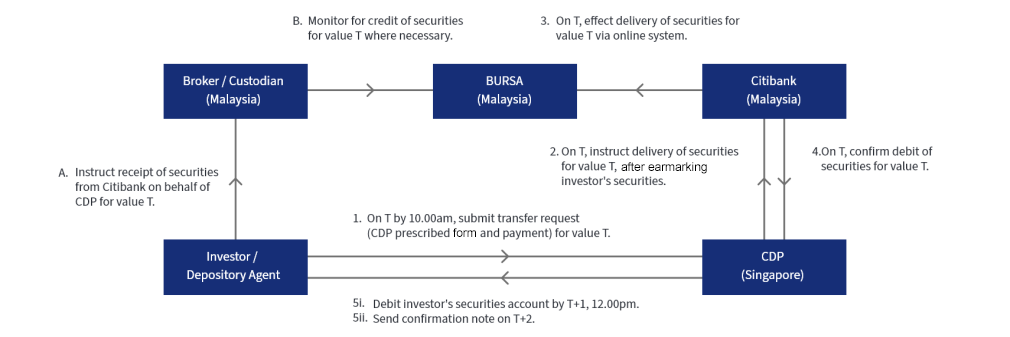

November 27 2021 at 834 pm. Malaysia has agreed in principle to implement global minimum tax of 15 on certain multinational companies MNCs said Inland Revenue Board IRB chief executive officer CEO Datuk Mohd Nizom SairiHe said Malaysia was among 136 countires announced by the Organisation for Economic Co-operation and Development OECD. Investors can use the Central Depository System to transfer securities from one CDS account to another provided the transfers are within the reasons approved by Bursa Malaysia Depository Sdn Bhd.

Share purchase plan SPP. Purchase the amount of cryptocurrency you desire. Such a practice is only possible when there is a level of control that can be exercised across the different entities.

In Malaysia its known as Borang 14A and it looks like this. If by way of love and affection the stamp duty is RM000 100 waived Property owned by Husband 50 shares and Wife 50 shares. THE decision to transfer Royal Malaysia Police PDRM personnel who are being investigated for their alleged involvement in a recent extortion case in Gombak to Sabah and Sarawak will be reviewed.

Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. Add the Cajun Butter and all the shrimp boil ingredients together. It can be securely stored in your Luno Wallet or you can transfer it out of the Luno exchange.

PUTRAJAYA Aug 1. All Economic Sectors Facility. Typically you invest in an SPP directly through the company itself.

Using a ladle pour the soup and a few pieces of tofu puffs on top of the noodles. The Memorandum of Transfer that we just mentioned is a form used to transfer ownership of property from one person to another. Form 24 is used to allot new shares to shareholders of a sdn bhd company.

CDS forms for the following transactions are now available for download on. The actual stamp duty is RM7000.

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Freehold Vs Leasehold Freehold Home Buying Tips Common Myths

Sample Letter Of Intent Letter Of Intent Letter Sample Letter Example

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

How Do You Legally Transfer Property To Someone Else In Asklegal My

Form 32a Share Transfer Form Company Registration In Malaysia

1 Nov 2018 Budgeting Inheritance Tax Finance

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

The World S Largest Manufacturer Of Glove

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

The Pros And Cons Of Freehold And Leasehold Property Freehold Investment Property Things To Come

.png)

The World S Largest Manufacturer Of Glove

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin

Rasa Malaysia Giovanni S Shrimp Scampi Copycat Recipe Couldn T Navigate The Website Through All The Pop Recipes Shrimp Recipes For Dinner Shrimp Scampi Recipe

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Issuance Of Share Certificates Case Facts By Hhq Law Firm In Kl Malaysia

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan